Hey there, fellow investor! Let’s dive into something that’s been making waves in the financial world—Voo and VTI. These two exchange-traded funds (ETFs) have captured the attention of both seasoned investors and newcomers alike. If you’re curious about what they are, how they work, and which one might be the better choice for your portfolio, you’ve come to the right place. Buckle up because we’re about to break it all down for you!

Before we get into the nitty-gritty, let me give you a quick rundown on why Voo and VTI are worth your attention. Both of these ETFs offer broad market exposure, low expense ratios, and are designed to track major indices. But here’s the kicker—they’re not exactly the same. Understanding their differences can help you make smarter investment decisions. So, are you ready to learn more?

Let’s set the stage: In today’s fast-paced financial landscape, having the right tools and knowledge is crucial. Voo and VTI are two of those tools, and they’re here to help you grow your wealth over time. Whether you’re looking to diversify your portfolio or simply want to understand the nuances of these funds, this guide is your one-stop shop for all things Voo and VTI.

Here’s a quick roadmap of what we’ll cover:

- What Are Voo and VTI?

- Key Differences Between Voo and VTI

- Performance Comparison

- Expense Ratio

- Diversification

- Market Cap

- Suitability for Your Portfolio

- Risk Factors

- Long-Term Potential

- Final Thoughts

What Are Voo and VTI?

Alright, let’s start with the basics. Voo (SPDR S&P 500 ETF Trust) and VTI (Vanguard Total Stock Market ETF) are two popular ETFs that give investors access to a diversified portfolio of stocks. Here’s a quick breakdown:

Voo: This ETF tracks the S&P 500 Index, which includes 500 of the largest publicly traded companies in the U.S. It’s like a snapshot of the cream of the crop in the American economy. If you’re looking for exposure to the biggest and most stable companies, Voo is your go-to.

VTI: On the other hand, VTI offers a broader perspective. It tracks the CRSP US Total Market Index, which includes thousands of companies—large, mid, and small-cap. Think of it as a more comprehensive view of the entire U.S. stock market.

Both ETFs are managed by reputable firms—Voo by State Street Global Advisors and VTI by Vanguard. These names alone should give you some peace of mind when it comes to trustworthiness and reliability.

Key Differences Between Voo and VTI

Scope of the Market

The first major difference lies in the scope of the market they cover. Voo focuses solely on the S&P 500, which means it’s more concentrated on large-cap stocks. VTI, however, casts a wider net, covering the entire U.S. stock market, including small and mid-cap companies. This broader scope can lead to more diversification but might also come with higher volatility.

Expense Ratio

Speaking of expenses, VTI generally has a lower expense ratio compared to Voo. While the difference might seem negligible at first glance, over time, those small percentages can add up to significant savings. For long-term investors, this is definitely something to consider.

Dividend Yield

Another point of distinction is the dividend yield. Voo tends to have a slightly higher dividend yield due to its focus on larger, more established companies that often pay dividends. VTI, with its inclusion of smaller companies, might have a slightly lower yield, but it compensates with its broader diversification.

Performance Comparison

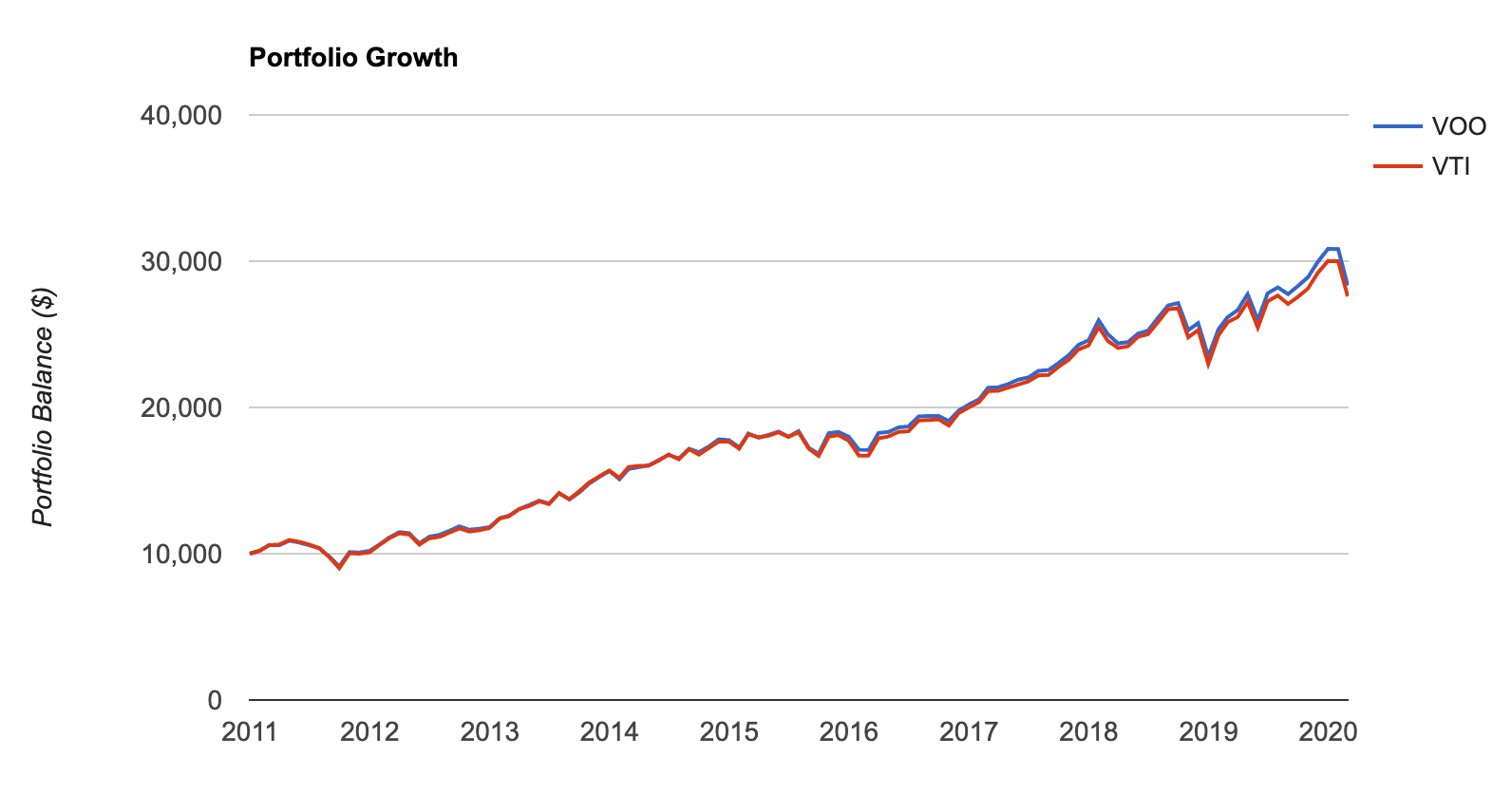

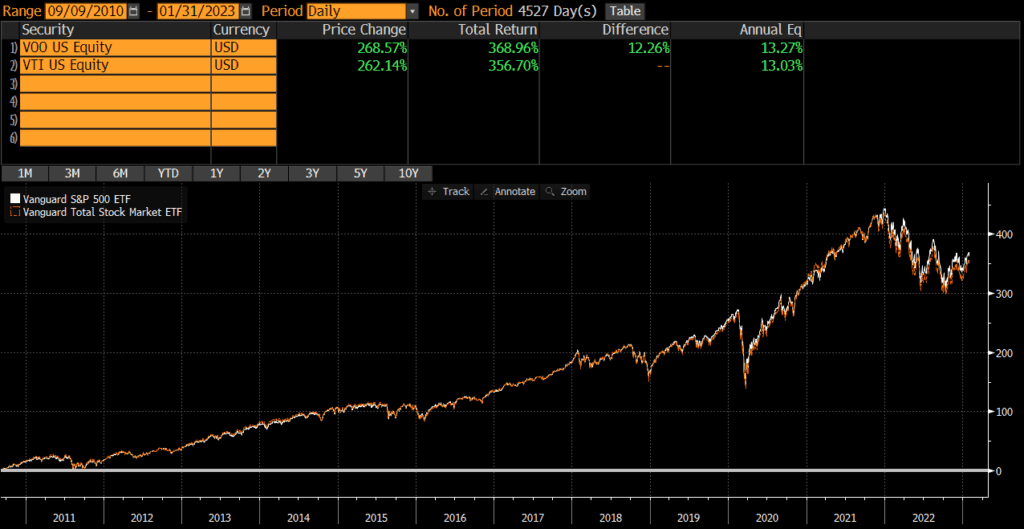

When it comes to performance, both Voo and VTI have delivered impressive returns over the years. Historically, Voo has shown slightly higher returns due to its concentration on large-cap stocks, which tend to perform well during bull markets. However, during market downturns, VTI’s broader diversification might offer some cushioning against losses.

Let’s look at some numbers. Over the past decade, Voo has delivered an average annual return of around 12%, while VTI has been slightly behind at around 11%. Keep in mind, past performance is not indicative of future results, so it’s important to consider other factors as well.

Expense Ratio

As mentioned earlier, the expense ratio is a crucial factor to consider. VTI currently boasts an expense ratio of just 0.03%, making it one of the cheapest ETFs available. Voo, on the other hand, has an expense ratio of 0.09%, which is still quite low but slightly higher than VTI.

Here’s a quick comparison:

- VTI: 0.03%

- Voo: 0.09%

While the difference might seem small, over time, it can amount to significant savings, especially for large portfolios.

Diversification

Diversification is key to managing risk in your portfolio, and both Voo and VTI offer solid options. Voo, with its focus on the S&P 500, provides exposure to 500 of the largest companies, which is already a good level of diversification. VTI takes it a step further by including thousands of companies across different market caps, giving you even more diversification.

Here’s a breakdown:

- Voo: 500 stocks

- VTI: Over 3,500 stocks

If you’re someone who values maximum diversification, VTI might be the better choice for you. But if you prefer a more focused approach, Voo could be the way to go.

Market Cap

Market capitalization, or market cap, is another important factor to consider. Voo primarily invests in large-cap stocks, which are generally considered less volatile and more stable. VTI, with its inclusion of mid and small-cap stocks, offers exposure to companies that might have more growth potential but come with higher risk.

Here’s how it breaks down:

- Voo: Large-cap focus

- VTI: Large, mid, and small-cap

Your risk tolerance and investment goals will play a big role in determining which one suits you better.

Suitability for Your Portfolio

Investment Goals

Your investment goals should guide your decision between Voo and VTI. If you’re looking for steady growth with lower risk, Voo might align better with your objectives. If you’re willing to take on a bit more risk for potentially higher returns, VTI could be the better fit.

Risk Tolerance

Understanding your risk tolerance is crucial. Voo’s focus on large-cap stocks makes it a safer bet, while VTI’s broader scope might expose you to more volatility. Consider your comfort level with market fluctuations before making a decision.

Risk Factors

No investment is without risk, and both Voo and VTI come with their own set of challenges. Market conditions, economic factors, and geopolitical events can all impact their performance. Additionally, while VTI offers more diversification, it also includes smaller companies that might be more susceptible to economic downturns.

It’s always a good idea to keep an eye on these factors and adjust your portfolio accordingly. Consulting with a financial advisor can also provide valuable insights tailored to your specific situation.

Long-Term Potential

Looking ahead, both Voo and VTI have strong long-term potential. The U.S. stock market has historically shown resilience and growth, and these ETFs are designed to capture that. Whether you choose Voo for its focus on large-cap stocks or VTI for its broader diversification, you’re positioning yourself for potential growth over time.

Remember, patience is key in investing. Sticking to your strategy and avoiding emotional decisions can help you achieve your financial goals.

Final Thoughts

So, there you have it—a comprehensive look at Voo and VTI. Both ETFs offer unique advantages and cater to different investment strategies. Whether you’re leaning toward Voo for its stability or VTI for its diversification, the most important thing is to align your choice with your financial goals and risk tolerance.

Before you go, here’s a quick recap:

- Voo: Focuses on the S&P 500, offers higher dividend yield, slightly higher expense ratio.

- VTI: Covers the entire U.S. stock market, lower expense ratio, broader diversification.

Now it’s your turn to take action. Leave a comment below sharing your thoughts on Voo and VTI. Which one do you think is the better choice? And don’t forget to check out our other articles for more investing insights. Happy investing, and may your portfolio grow as big as your dreams!