Let's cut straight to the chase, folks. If you're diving into the world of ETFs, you've probably come across two heavyweights: VOO and VTI. These aren't just any funds—they're like the LeBron James and Tom Brady of the ETF world. But which one deserves a spot on your financial team? Let's break it down for you in a way that makes sense without all the financial jargon choking you.

Imagine walking into a diner with a menu full of options, but you only have room for one plate. That's kind of what it's like when you're choosing between VOO and VTI. They both offer delicious financial opportunities, but they're not exactly the same dish. One might be a classic burger, while the other is a gourmet steak. Both are great, but your choice depends on what you're craving—or in this case, what your investment goals are.

Now, before we dive deep into the nitty-gritty, let’s establish something: both VOO and VTI are designed to give you access to the stock market in a way that's simple, cost-effective, and hassle-free. But they're not identical twins. They have different personalities, just like how some people prefer pizza over tacos—or vice versa. So, let’s figure out which one fits your financial appetite.

Daftar Isi

- Introduction to VOO vs. VTI

- What Are VOO and VTI Anyway?

- Fee Structure: Which One Costs Less?

- Index Differences: S&P 500 vs. Total Stock Market

- Performance: Who’s Winning the Race?

- Liquidity: How Easy Is It to Trade?

- Dividends: Cash in Your Pocket?

- Tax Efficiency: Who’s the Better Tax Player?

- Which One Fits Your Portfolio?

- Final Verdict: VOO or VTI?

Introduction to VOO vs. VTI

Let’s get one thing straight: VOO and VTI are two of the most popular ETFs out there. They’re not just random acronyms; they represent two distinct ways to invest in the stock market. VOO tracks the S&P 500, which is like the all-star team of large-cap U.S. companies. On the other hand, VTI gives you exposure to the entire U.S. stock market, including small-cap and mid-cap companies. It’s like the difference between watching the NBA Finals and the entire NBA season.

But why should you care? Well, if you’re looking to build a solid investment portfolio, understanding the differences between these two ETFs can make a world of difference. It’s not just about picking one and hoping for the best; it’s about aligning your investment strategy with your financial goals. Whether you’re saving for retirement, a down payment on a house, or just trying to grow your wealth, VOO and VTI can both play a role—but which one should you choose?

What Are VOO and VTI Anyway?

Before we dive into the specifics, let’s take a quick look at what these ETFs are all about:

VOO: The S&P 500 Powerhouse

VOO, or the Vanguard S&P 500 ETF, is like the captain of the team. It tracks the S&P 500 index, which includes 500 of the largest and most well-known companies in the U.S. Think Apple, Microsoft, Amazon—you get the picture. If you want exposure to the biggest and best companies in the country, VOO is your go-to.

VTI: The Total Market Giant

VTI, or the Vanguard Total Stock Market ETF, is like the team’s all-around player. It gives you access to the entire U.S. stock market, including small-cap, mid-cap, and large-cap companies. This means you’re not just investing in the big names; you’re also getting a piece of the smaller, up-and-coming companies. It’s like investing in the future of the U.S. economy.

Fee Structure: Which One Costs Less?

When it comes to investing, fees matter. Even a small difference in expense ratios can add up over time. So, how do VOO and VTI stack up?

- VOO Expense Ratio: 0.03%

- VTI Expense Ratio: 0.03%

Surprise, surprise—they’re the same! Both VOO and VTI have rock-bottom expense ratios, making them some of the cheapest ETFs on the market. But don’t let that fool you—just because they cost the same doesn’t mean they’re identical. Other factors, like trading costs and tax efficiency, can still make a difference.

Index Differences: S&P 500 vs. Total Stock Market

This is where things get interesting. VOO tracks the S&P 500, which means it focuses on large-cap companies. These are the tried-and-true giants of the market. VTI, on the other hand, gives you exposure to the entire U.S. stock market, including small-cap and mid-cap companies. Think of it like this: VOO is like investing in the NFL, while VTI is like investing in all of sports. Both have their pros and cons.

Pros of VOO:

- Focuses on large, stable companies

- Lower volatility compared to VTI

- Higher dividend yield

Pros of VTI:

- Broad market exposure

- Potential for higher growth

- More diversified

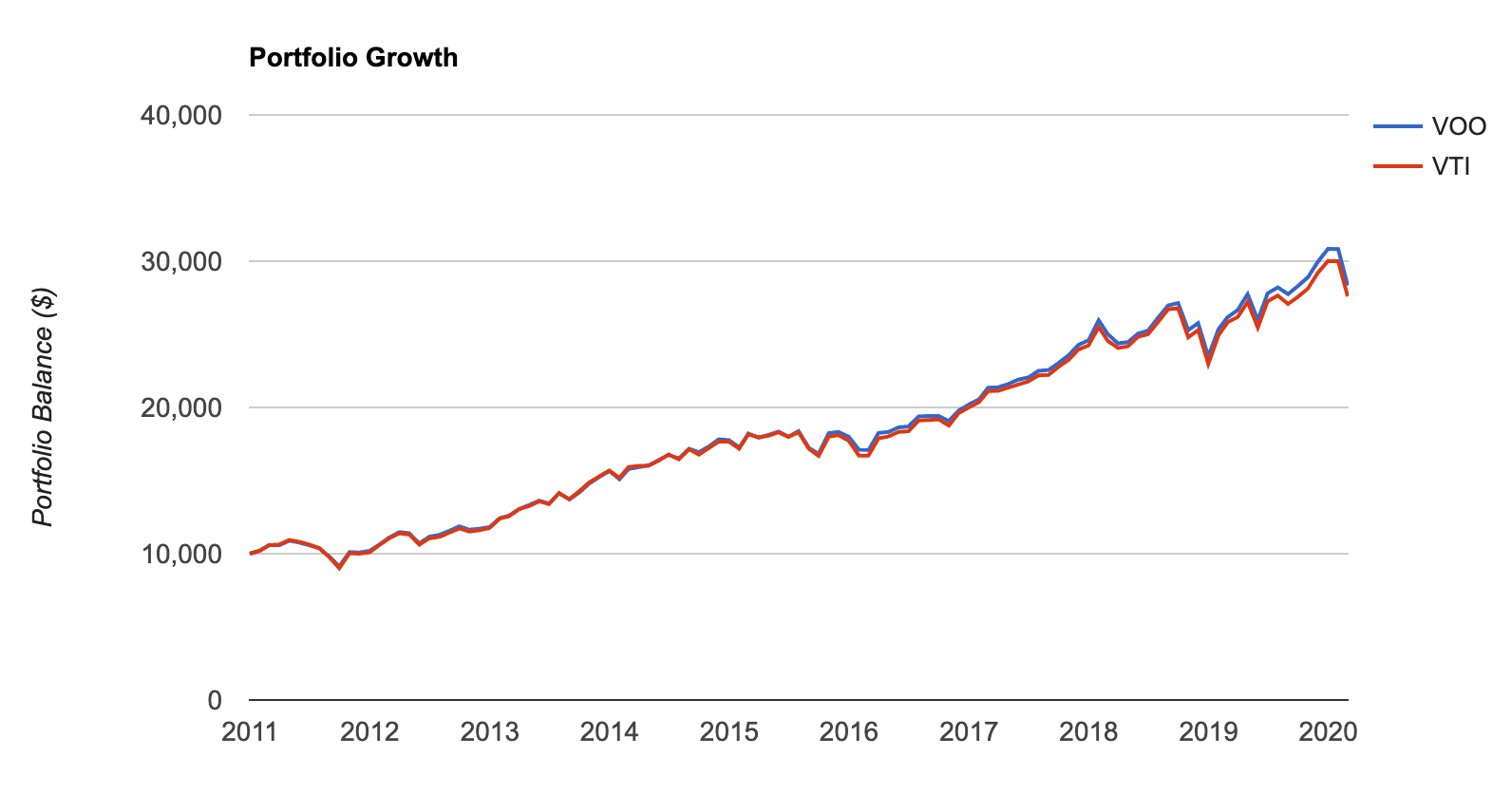

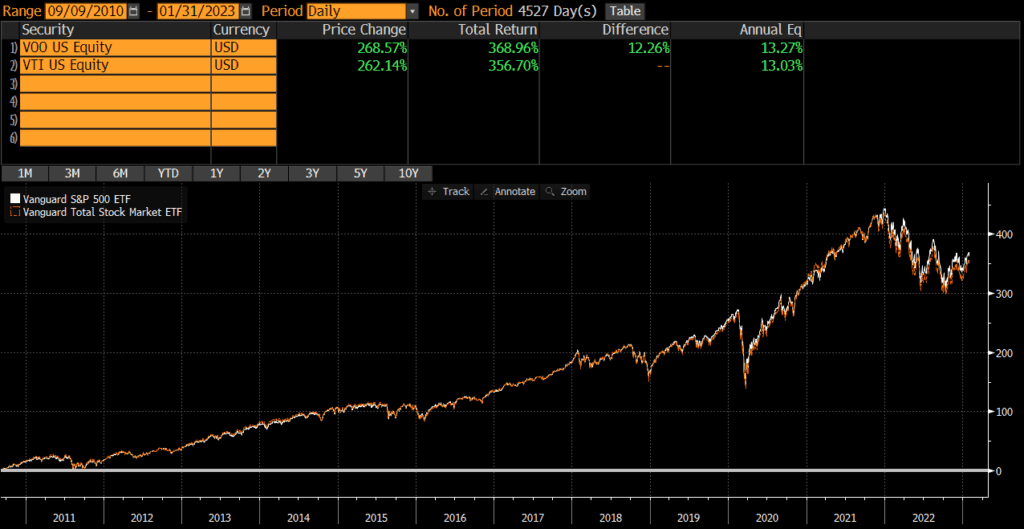

Performance: Who’s Winning the Race?

When it comes to performance, both VOO and VTI have delivered solid returns over the years. But here’s the thing: VOO tends to outperform during bull markets because it’s heavily weighted toward large-cap companies. VTI, on the other hand, can shine during periods of small-cap outperformance. It’s like choosing between a Ferrari and a Jeep—both are great, but they excel in different environments.

Let’s look at some numbers:

- VOO 10-Year Annualized Return: 11.68%

- VTI 10-Year Annualized Return: 11.59%

As you can see, the difference is negligible. But over time, even small differences can add up, so it’s worth considering which one aligns better with your investment strategy.

Liquidity: How Easy Is It to Trade?

Liquidity is another important factor to consider. Both VOO and VTI have high trading volumes, which means you can buy and sell them easily without worrying about slippage. But VOO tends to have slightly higher trading volume, which can make it a bit easier to trade in large quantities.

That said, unless you’re a professional trader moving massive amounts of shares, the difference in liquidity probably won’t matter much to you. For most individual investors, both ETFs are plenty liquid.

Dividends: Cash in Your Pocket?

Both VOO and VTI pay dividends, which is always a nice perk. But VOO tends to have a slightly higher dividend yield because it’s focused on large-cap companies, which are more likely to pay dividends. If you’re looking for a steady stream of income, VOO might be the better choice.

- VOO Dividend Yield: 1.60%

- VTI Dividend Yield: 1.40%

Again, the difference isn’t huge, but if you’re relying on dividends for income, it’s worth considering.

Tax Efficiency: Who’s the Better Tax Player?

When it comes to taxes, both VOO and VTI are tax-efficient because they’re index funds. However, VTI tends to be slightly more tax-efficient because it has fewer capital gains distributions. This is because VTI’s broader market exposure allows it to better manage tax liabilities.

That said, the difference in tax efficiency is usually small, so it’s not a huge factor for most investors. But if you’re investing in a taxable account, it’s worth keeping in mind.

Which One Fits Your Portfolio?

Now that we’ve covered the key differences between VOO and VTI, let’s talk about which one might be right for you:

- Choose VOO if: You want exposure to large-cap companies, prefer lower volatility, and are looking for a higher dividend yield.

- Choose VTI if: You want broad market exposure, are comfortable with higher volatility, and are looking for potential long-term growth.

Ultimately, the choice depends on your investment goals, risk tolerance, and time horizon. There’s no one-size-fits-all answer—both ETFs have their strengths and weaknesses.

Final Verdict: VOO or VTI?

So, which one should you choose? The truth is, there’s no clear winner. Both VOO and VTI are excellent ETFs that can help you achieve your financial goals. If you’re looking for a more focused, stable investment, VOO might be the better choice. But if you want broader market exposure and the potential for higher growth, VTI could be the way to go.

Here’s what we recommend: take a step back and think about your investment strategy. What are your goals? How much risk are you willing to take on? Once you’ve answered those questions, the choice between VOO and VTI should become a lot clearer.

And don’t forget to leave a comment below and let us know which one you prefer. Or, if you’re still not sure, feel free to share this article with a friend and start a conversation. After all, investing is all about making informed decisions—and we’re here to help you do just that.